do nonprofits pay taxes on rental income

The nations average rate is 107 which is pricey compared to Europe and the rest of the world. The IRS applies a similar rule to capital gains on the sale of real estate.

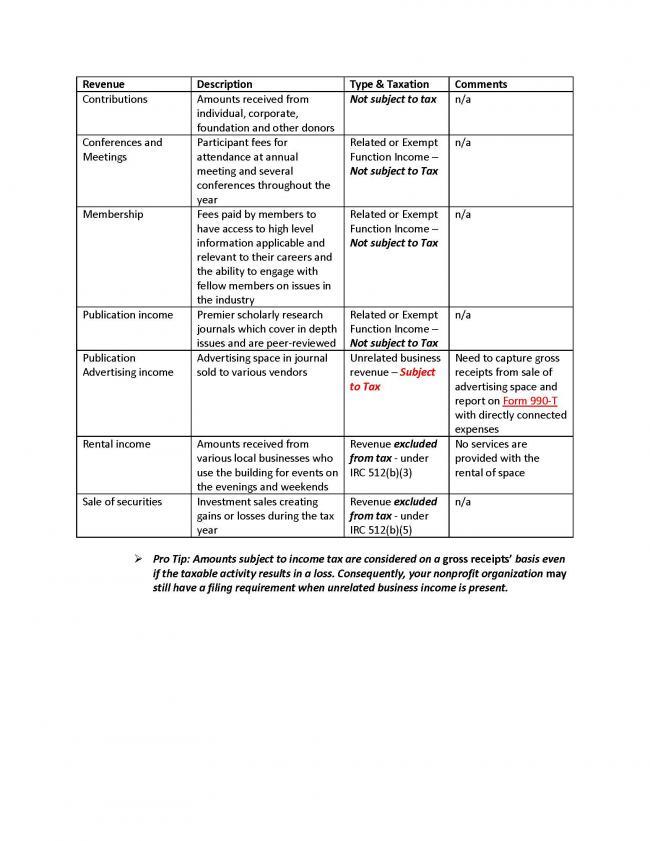

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

Factors that determine whether the income is taxable include whether the tenants activities are.

. While this may look like a lot of money in the aggregate New Hampshires giving as a percentage of income is about the lowest in the United States. A non-profit organization NPO as described in paragraph 149 1 l of the Income Tax Act. Property Tax Rates Explained.

And while churches are not allowed to. The tax treatment of the gains depends on whether the property. If a nonprofit runs an unrelated business to raise money -- one thats not part of the core mission -- the unrelated business income is taxable.

Up to 25 cash back While nonprofits can usually earn unrelated business income UBI without jeopardizing their nonprofit status they have to pay corporate income taxes on it under both state and federal corporate tax rules. These include Federal Income Tax Withholding FITW Social Security and Medicare FICA and State Unemployment Taxes SUTA. The IRS defines unrelated business income UBI as income from a trade or business regularly carried on by a nonprofit organization that is not substantially related to the performance by the organization of its exempt function.

This guide is for you if you represent an organization that is. Generally the first 1000 of unrelated income is not taxed but the remainder is Lets go back to the Friends of the Library. There are clear rules as well as several exceptions to.

One source of UBI is rental income. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction. RAB 2016-18 Sales and Use Tax in the Construction Industry.

Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. Because churches operate to serve peoples spiritual needs foster a sense of community and undertake charity they are tax-exempt and allowed to accept tax-free donations. Form 3372 Michigan Sales and Use Tax Certificate of Exemption.

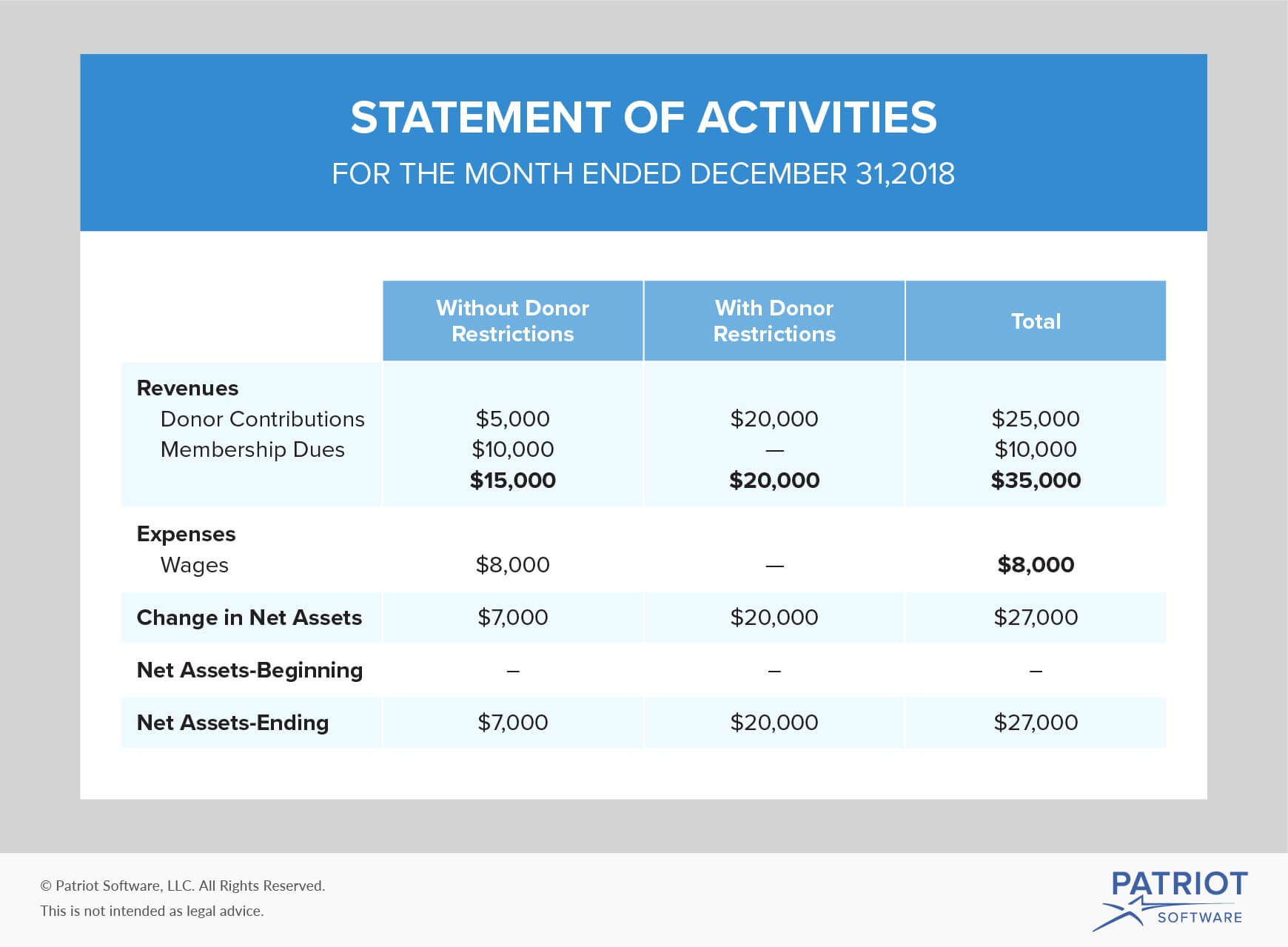

However this corporate status does not automatically grant exemption from federal income tax. We never bill hourly unlike brick-and-mortar CPAs. Exempt nonprofits generally do not have to pay taxes on their incomes but some types of income are taxable.

Federal Tax Obligations of Non-Profit Corporations. However not all rental income is subject to unrelated business income tax UBIT. To be tax exempt most organizations must apply for recognition of.

Im heading up a project for my community to go solar and we are an HOA nonprofit. An agricultural organization a board of trade or a chamber of commerce as described in paragraph 149 1 e of the Act. In New Hampshire those private donations amount to just 185 percent of the state taxpayers adjusted gross income or a total of just under 550 million.

501c3 tax-exempt nonprofit organizations are exempt from paying Federal Unemployment Taxes FUTA but will have to either pay into their states unemployment program or opt-out and directly pay any unemployment. 2 days agoMy question is how will the direct pay be for nonprofits. Your annual tax bill is calculated by multiplying the assessed value of the.

Form 3520 Michigan Sales and Use Tax Contractor Eligibility Statement for Qualified Nonprofits. The amount was 1110 in 2019 is taxable. Understandably most charities in the.

Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry. But determining what are an organizations exempt purposes is not always as clear as one might think and distinguishing between related and unrelated activities can be tricky. Even though the federal government awards federal tax-exempt status a state can require additional documentation to.

If you do pay federal income taxes then you will only receive back what you pay in. Even tax-exempt nonprofits sometimes earn taxable income. The research to determine whether or not sales tax is due lies with the nonprofit.

Churches and religious organizations are almost always nonprofits organized under Section 501 c 3 of the Internal Revenue Code. Taxable if Income from any item given in exchange for a donation that costs the organization not the customer more than a certain amount to obtain based on 5 in 1987. Enjoy flat rates with no-surprises.

I estimate our cost to be about 600000. While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes. Tax Exempt if All unrelated items eg snacks and drinks Minimum Suggested Donation items.

Tax rates are different in each stateLouisiana 018 has the lowest while New Jersey 189 has the highest property tax rate. Depending on the circumstances the rental income might be considered unrelated business income a taxable income category for nonprofits. If your personal liability is lets say 10000 then next year.

Accounting Spreadsheets And Document Examples Nonprofit Accounting For Volunteers Treasurers And Bookkeepers

Misuse Of Funds Nonprofit Help Fraudulent Misappropriation

Irs Form 9465 Can T Pay Your Taxes All At Once Read This

Free Cash Flow Forecast Templates Smartsheet

Should Nonprofits Seek Profits

To Buy Or To Rent Evaluating The Right Path For Your Non Profit

What Are Functional Expenses A Guide To Nonprofit Accounting

Accounting For Nonprofit Organizations Financial Statements Beyond

Guide To Tax Deductions For Nonprofit Organizations Freshbooks

7 Leasing Tips For Nonprofits The Nonprofit Centers Network

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping

Beginner S Guide To Rental Income For Non Profits Taxable Or Not Blue Co Llc

![]()

Guide To Gst Hst Information For Nonprofit Organizations Enkel

Property Tax Exemptions For Nonprofits Blue Co Llc

![]()

Canadian Tax Requirements For Nonprofits Charitable Organizations

![]()

Canadian Tax Requirements For Nonprofits Charitable Organizations