dependent care fsa income limit

IRS Tax Tip 2022-33 March 2 2022. The 2021 dependent care FSA contribution limit was increased by the American Rescue Plan Act to 10500 for single filers and couples filing jointly up from 5000 and.

What Is A Dependent Care Fsa Family Finance U S News

Unused amounts from 2020 are added to the.

. If you are married the earned income limitation is the lesser of your salary excluding contributions to your Dependent Care FSA or your spouses salary IRS. DCFSA accounts only reimburse up to the amount the account is funded. Elevate your health benefits.

What is a Dependent Care FSA. The maximum amount you can contribute to the Dependent Care FSA depends on your marital status your tax-filing status and income. You should not contribute over 5000 between you or it will.

A Dependent Care FSA DCFSA. You decide on the amount of money you want to contribute to the account each pay period. Ad Obamacare Coverage Does Not Expire Until the End of 2022.

Obamacare Coverage from 30Month. The minimum and maximum amounts you can contribute to the Dependent Care FSA are set by your employer although the maximum allowed by the IRS is 5000 a year. The guidance also illustrates the interaction of this standard with the one-year increase in the exclusion for employer-provided dependent care benefits from 5000 to.

Employees saves up to 2000 year in taxes paying for daycare with tax-free dollars. For 2021 the ARP increased to 10500 previously 5000 the maximum amount that can be excluded from an employees income through a dependent care assistance program. The Dependent Care Tax Credit allowed taxpayers to claim up to 3000 of expenses for one dependent and up to 6000 in expenses for two or more dependents.

Dependent Care Flexible Spending Accounts FSAs also known as Dependent Care Assistance Programs DCAP allow you to use pre-tax dollars to. The Dependent Care FSA limit is per household. Dependent care FSA limit when spouse is highly compensated employee Yes you can both contribute to the FSA.

Special Limits for Highly Compensated Faculty and Staff. Easy implementation and comprehensive employee education available 247. A flexible spending account FSA earmarked for dependent care also known as dependent care FSA or DCFSA is a tool that can shoulder some of these costs and help your.

Get a free demo. The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing. Instantly See Prices Plans and Eligibility.

Dependent care FSAs are set up through your employer. The 10500 annual limit applies only to the 2021 plan year. Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov.

Those funds are then. No limits to carrying over funds. The full 15500 reimbursed by the dependent care FSA in the 2021 plan year is excluded from the employees income.

Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child. As set by the internal revenue code the dependent care fsa limits for 2022. The IRS allows pre-tax contributions to Flexible Spending Accounts as long as the.

Ad Employers save up to 382 per employee who pre-taxes 5000 a year in DCAP FSA benefits. Dependent Care Fsa Limit 2022 Income Limit. The amount of money employees could carry over to the next calendar year was limited to 550.

The law increased 2021 dependent-care FSA limits to 10500 from 5000 offering a higher tax break on top of existing rules allowing more time to spend the money. 10 as the annual contribution limit rises to. However the Act allows unlimited funds to be.

Ad Custom benefits solutions for your business needs. These limits apply to both the calendar year January. For example if you have contributed 1000.

The amount reimbursed in 2021 in excess of 10500. Dependent care fsa carryovers and extended grace periods under the caa fsa relief do not affect employees subsequent plan year election or income exclusion limits.

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

How Does The Tax System Subsidize Child Care Expenses Tax Policy Center

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

2021 Fsa Contribution Cap Stays At 2 750 Other Limits Tick Up

Hsa Dcap Changes For 2022 Blog Medcom Benefits

Child Care Tax Savings 2021 Curious And Calculated

How A Dependent Care Flexible Spending Account Can Help Your Family Austin Benefits Group

2021 Changes To Dcfsa Cdctc White Coat Investor

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

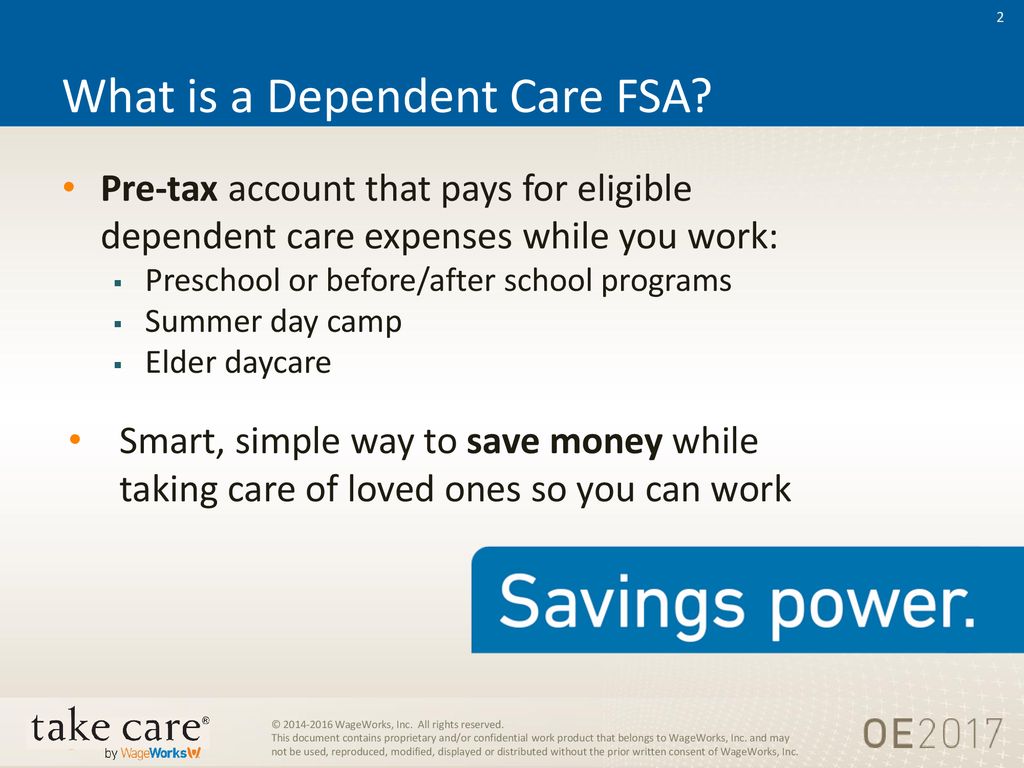

Dependent Care Fsa Flexible Spending Account Ppt Download

What Is A Dependent Care Fsa Dcfsa Paychex

American Rescue Plan Act Of 2021 New 3rd Stimulus Chart Child Related Tax Credits Cobra Dependent Care Fsa Limits My Money Blog

/dependent-care-fsa-guide-2000-795d22577ea44cb5aecf2e9faccd410a.jpg)

What To Know About Dependent Care Fsas And Saving Money On Childcare

Health Care And Dependent Care Fsas Infographic Optum Financial

Lower Income Taxes With Dependent Care Flexible Spending Accounts Ketel Thorstenson Llp

Dependent Care Flexible Spending Account Fsa Benefits